1301 Second Avenue 18th. Dollar denominated securities of large-capitalization companies that derive a majority of their.

Fidelity Equity Income Strategy A Separately Managed Account Fidelity

Simplify streamline cap table management.

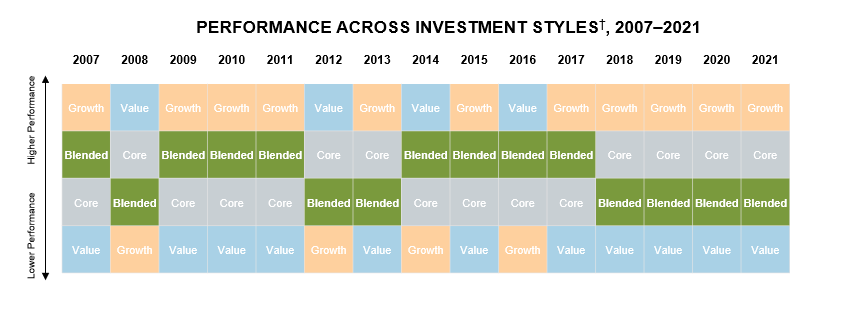

. The Russell 1000 value index is a 165 forward PE while the. Has anyone used the Fidelity Tax-Managed US. Gain access to the Nasdaq-100 Index at 1100th the notional value.

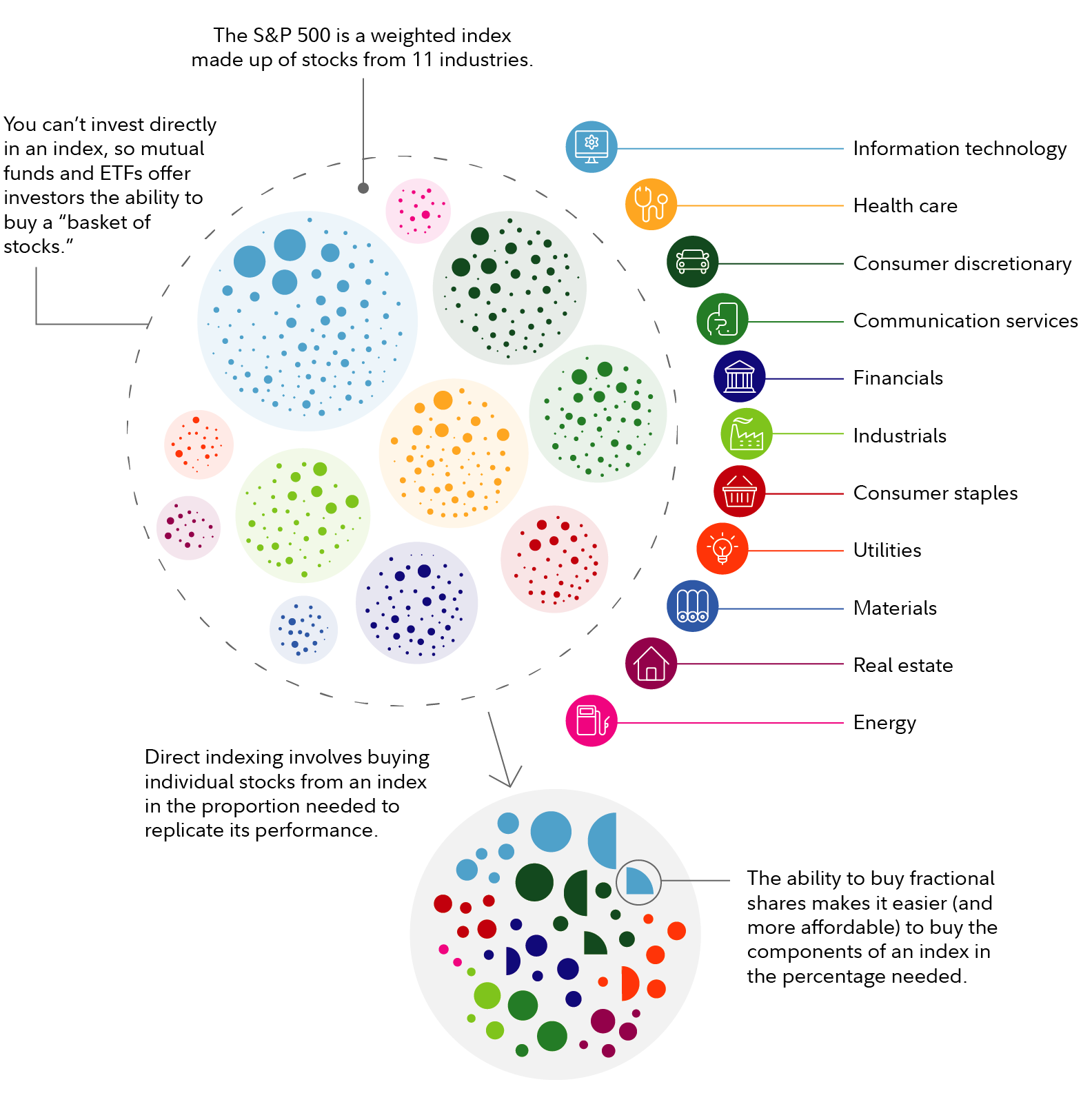

I used two broadly diversified equity index funds for the bulk of the portfolio--a larger position in a total US. Your Slice of the Market Done Your Way. Equity Index Strategy and the Equity Income Strategy each require 200000 to get in.

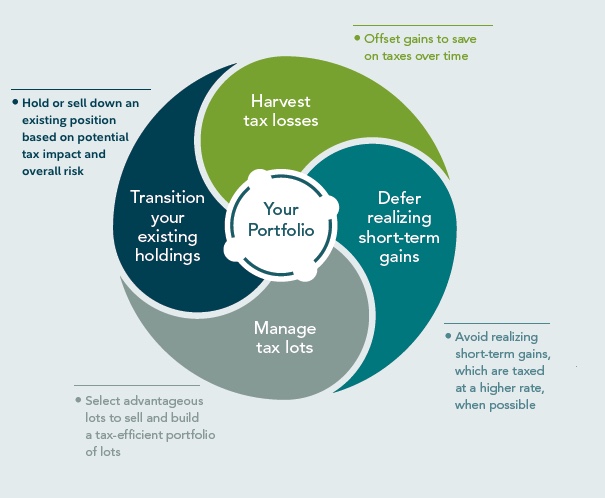

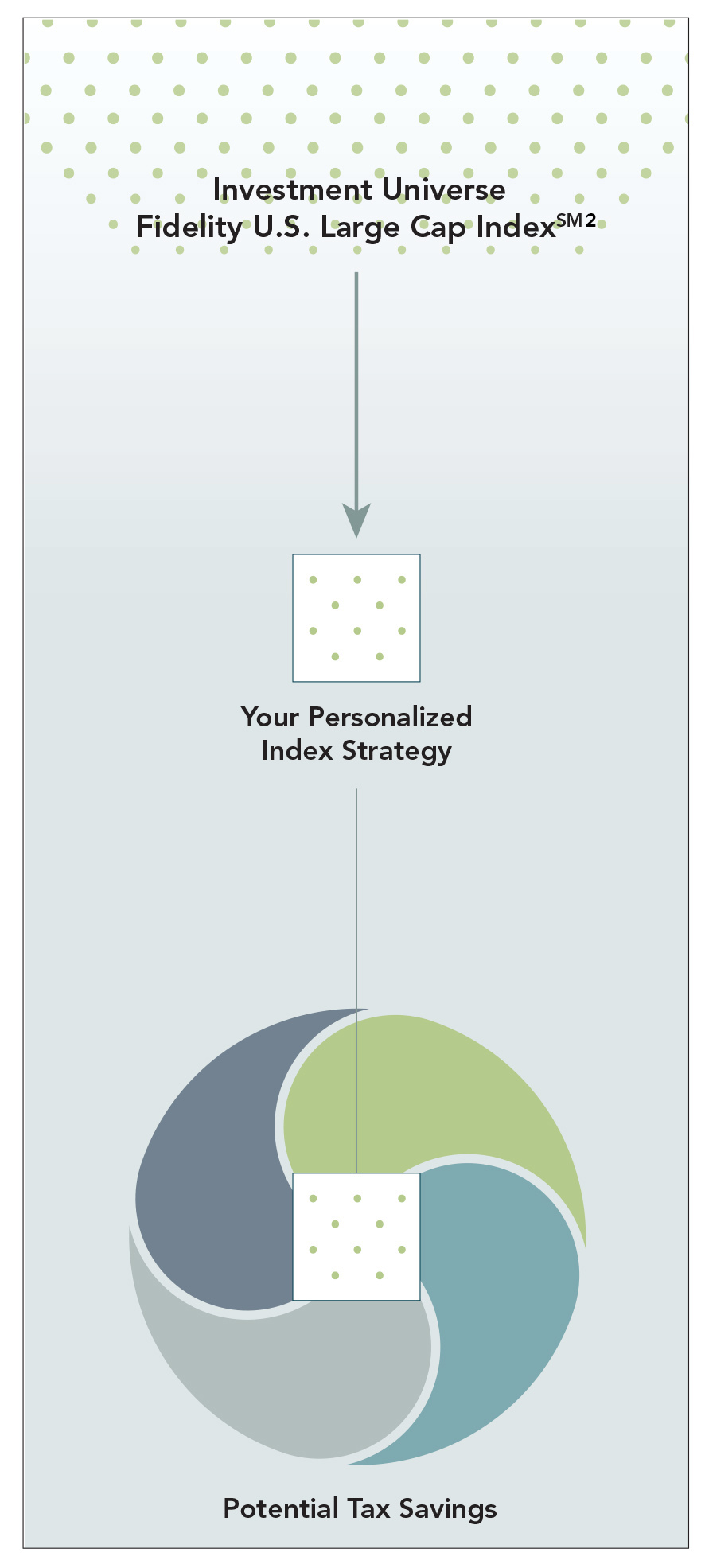

At Eaton Vance we think about taxes year round so you can focus on what matters most. Our experts work side-by-side with you to build a personalized solution for your clients. Taxes are one of the largest expenses for investors.

Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options. On top of the gap between the valuation of European growth and value there is the gap between US value and European value. Gain access to the Nasdaq-100 Index at 1100th the notional value.

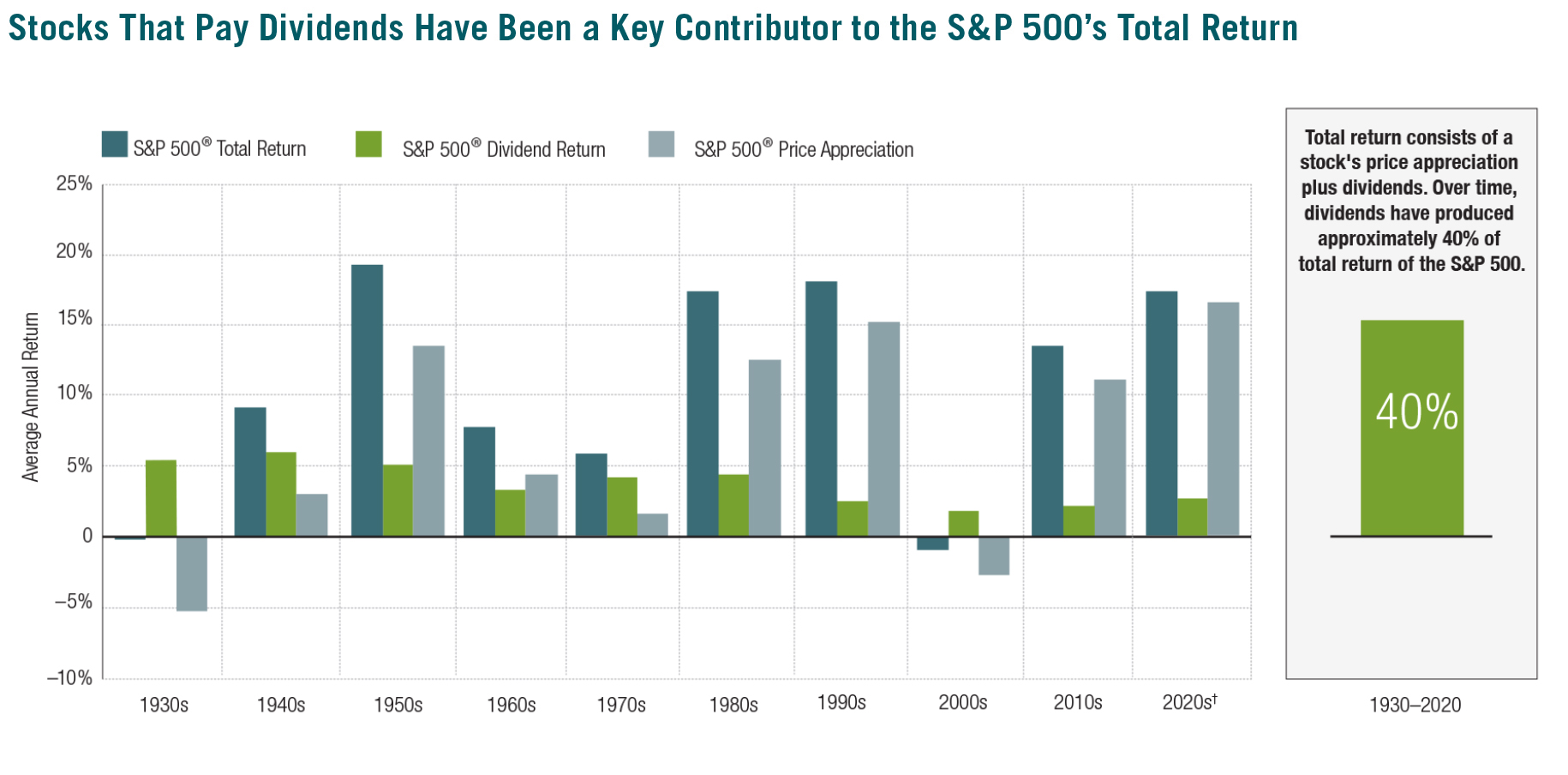

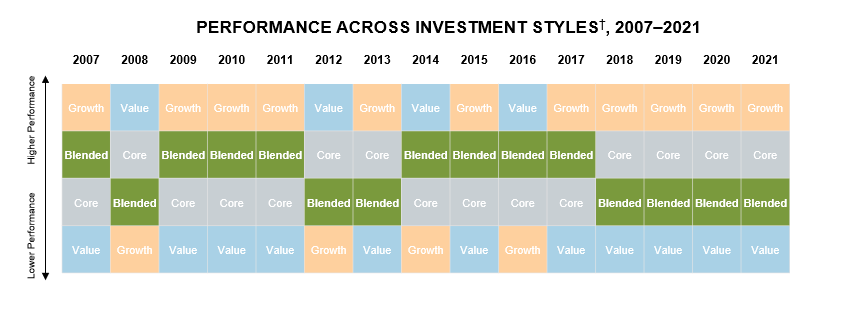

1 Investment universe is US Large Cap equities 2 Equity market volatility is 16 annualized 3 Dividend yield is 2 annualized and dividends are reinvested into. Want To Learn More About Investing. Direct investing isnt a new strategy.

The strategies charge 020 percent to 065. Its a separately managed account that requires a 200K minimum and charges an annual fee of 20-65 depending on. Ad Honest Fast Help - A BBB Rated.

The Tax Managed International Equity Fund primarily invests in non-US. Ad SMAs that track an equity index while incorporating tax loss harvesting. Ad Certent Equity Management is all you need to manage report on equity compensation.

Join Hosts Katie Koch And Alison Mass. To avoid a sky-high payment private wealth managers may suggest a tax-managed equity or TME strategy. For example Fidelitys Tax Managed US.

How Business Leaders can Improve Their Digital Investment Strategy Reach Higher Returns. Private equity portfolio management software. Ad Access tax-forward insights tools strategies for maximizing after-tax return potential.

Start wNo Money Down 100 Back Guarantee. Ad Hear Leading Investors Speak About Their Strategies For Navigating Todays Market. Market tracker and a smaller stake in a fund that tracks the MSCI.

Ad Review the Key Highlights from the EY-Parthenon 2022 Digital Investment Index. Leveraging etfs for tax managed index strategies offers a more streamlined experience for both advisors and clients. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options.

The Tax-Managed Equity Growth Model Strategy seeks to provide on an after-tax basis high long-term capital appreciation.

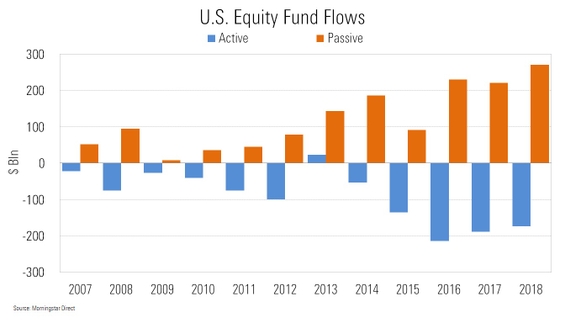

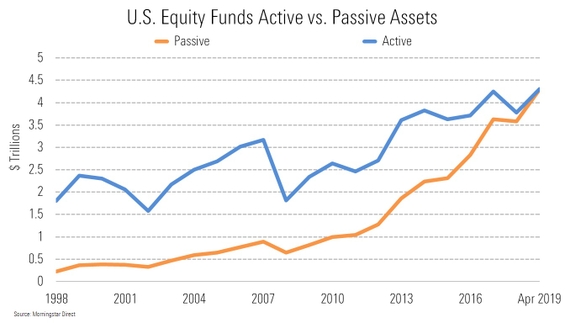

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

A Simple Smart Way To Invest With Impact

Fidelity Tax Managed Us Equity Index Strategy Fidelity

Separately Managed Accounts U S Large Cap Equity Fidelity

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

0 comments

Post a Comment